Construction Bonds

Construction Bonds are a type of surety bond that protects against disruptions or financial loss if the contractor fails to complete a project or fails to meet specific specifications of a contract.

Road and Sewer Bonds Explained Simply

Construction Bonds are a type of surety bond that protects against disruptions or financial loss if the contractor fails to complete a project or fails to meet specific specifications of a contract. Bonds ensure that a construction project’s bills will get paid.

Used widely in the construction industry, a construction surety bond is used as a credit instrument that binds the contractual obligations between all parties. Surety bonds give assurance for financial security by providing owners and developers with the confidence that their contractors will perform according to the terms of the agreement.

There are multiple types of Bonds available, but they all have in common a basic principle of how they function:

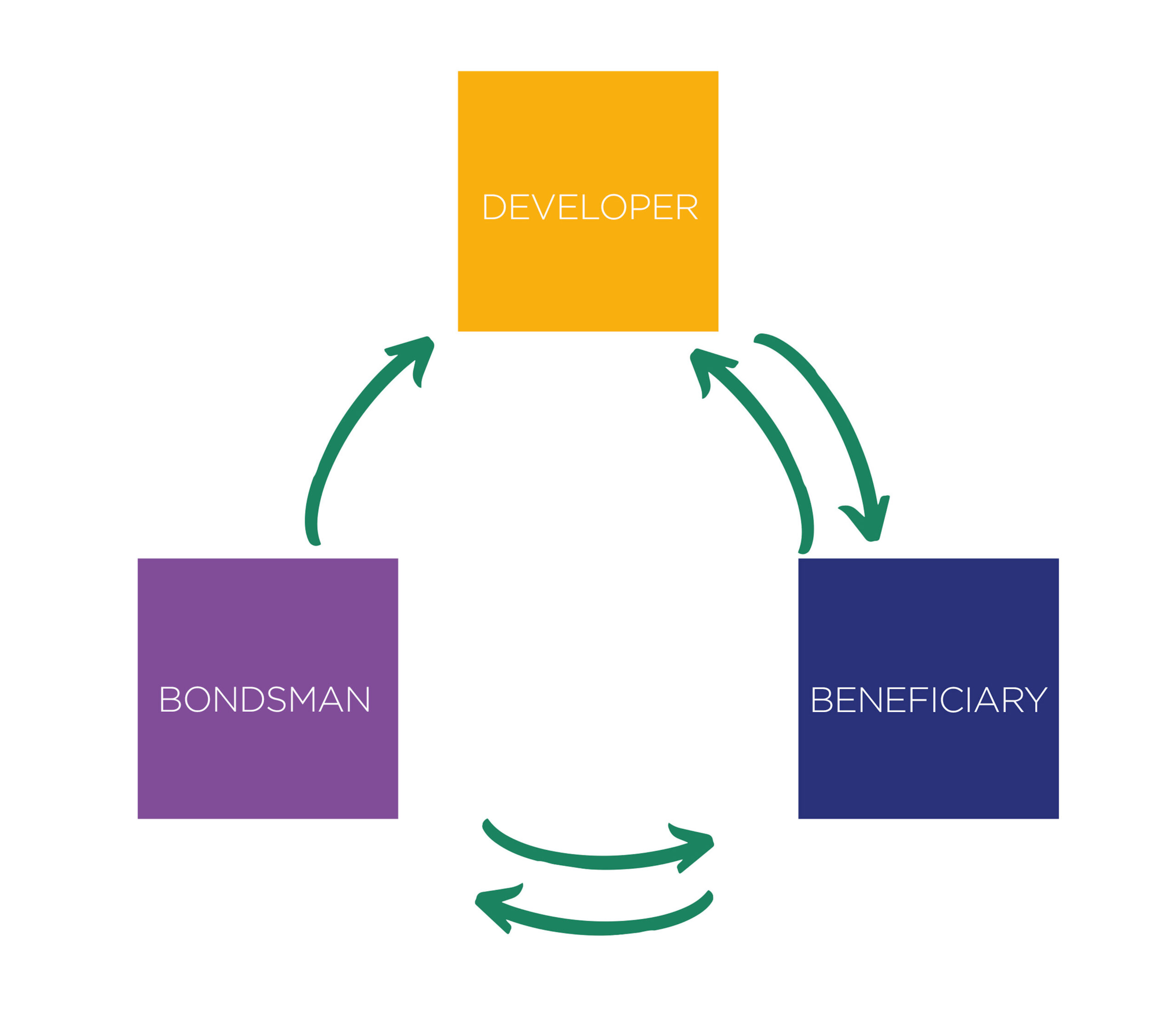

Bond Agreements: Tri-Party Contract Obligations:

Commitment from the DEVELOPER to construct the roads / sewers to the Beneficiary’s (Adopting Party) specification and the technically approved design, and the obligation to pay the bondsman for the bond.

Commitment from the BENEFICIARY (Local Authority / Water Company) to the bondsman and developer to adopt the infrastructure once constructed to their approval and all associated obligations satisfied.

Commitment from the BONDSMAN (Insurer) to pay for any outstanding or unsatisfactory works if the developer defaults on their obligations within the agreement.

REQUEST A CALLBACK FOR MORE INFORMATION

Compariqo can quote you on a range of construction bonds. Whether you need a performance bond to provide assurance that a contractor will perform his obligations under the agreement, a payment bond to guarantee payments to workers and suppliers or a bid bond to protect project owners, we can find the right cover for you.

Road and Sewer Bonds

(also known as Section 38) and Sewer Bonds (known as Section 104).

Deposit Protection

Give purchasers peace of mind knowing that their deposit will not be lost.

Payment Bonds

Ensure cash flow is there when its needed.

Performance Bonds

Guarantee that work will be carried out to a satisfactory standard in accordance with the contract of works.

WE’RE HERE TO HELP. CONTACT US TO SEE HOW WE CAN ASSIST WITH YOUR PROJECT…